1099-MISC Blank Form

If you've heard of the 1099 form but are feeling a bit confused about what it is and who it's for, don't worry. You're not alone. Simply put, if you've done some work as a freelancer or independent contractor, you'll likely need to deal with this form when tax time rolls around. A 1099 form reports your income outside of a traditional job.

Functionality of the 1099 Tax Form

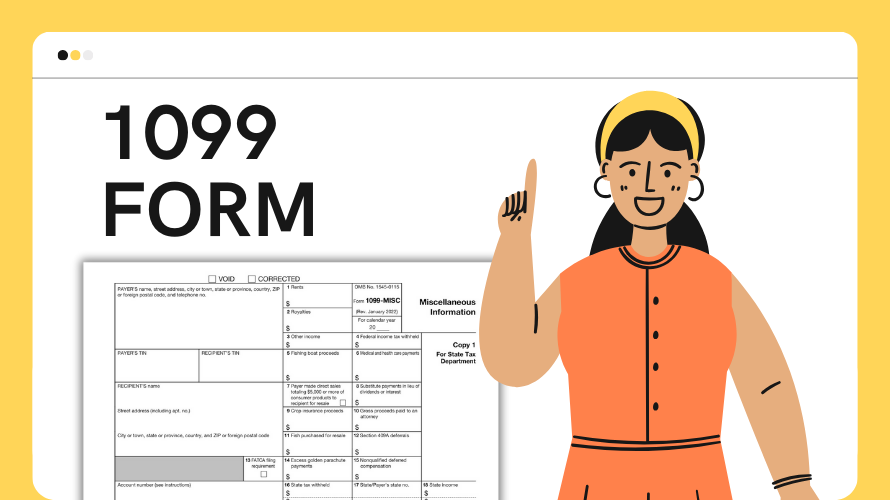

When it's time to report your income, you might be looking for a printable blank 1099 form. These are handy because they allow you to fill in your details without having to worry about the format. You can easily get a blank 1099 form in PDF format online. Now, this is important: you can't just print any old 1099 you find on the web. The IRS is pretty specific about the paper and ink, so make sure you get an official version that is acceptable.

For those of you who had to pay different types of non-employee compensations or maybe rented a property, you will likely reach for a 1099-MISC blank form. The 1099-MISC is a special form used to report miscellaneous income. For 2023, it is crucial to get the correct version of the blank 1099-MISC form for 2023 because the IRS updates forms, and you want to make sure all of your information is current and correct.

IRS 1099-MIS Form: Key Points to Remember

- Double-check the Taxpayer Identification Number (TIN) you enter. It's important!

- Make sure to report the correct amount of money you paid or received.

- Never leave any required fields blank. If you're not sure, ask a tax professional.

Common Mistakes on Federal Form 1099

When filling out your 1099-MISC, there are some typical slip-ups you'll want to watch out for:

- Incorrect Information

Always review your forms for any incorrect or incomplete information. Typos can lead to big headaches later on. - Reporting Personal Expenses

Remember, the 1099-MISC is for business or rental transactions, not personal ones. - Delay in Filing

Procrastination is not your friend when it comes to taxes. Missing the filing deadline may lead to penalties.

To prevent these errors, give yourself enough time to gather all the necessary information before you start filling out your form. And hey, if you're feeling unsure, consider seeking help from a tax expert. They're like navigators for the stormy seas of tax filing.

Getting a blank 1099 form for print is crucial if you're handling your taxes without an employer. You can find the forms you need, like the blank 1099 form or the 1099-MISC blank form, through the IRS website or a trusted tax resource. Always make sure to use the updated version for the year you're reporting, and don't forget to handle them carefully. Taxes might sound intimidating, but with the right form and a bit of patience, you'll navigate through them just fine.

Latest News

-

![Free 1099 Printable Form]()

- 22 November, 2023

-

![1099 Tax Form Template]()

- 21 November, 2023