Free 1099 Printable Form

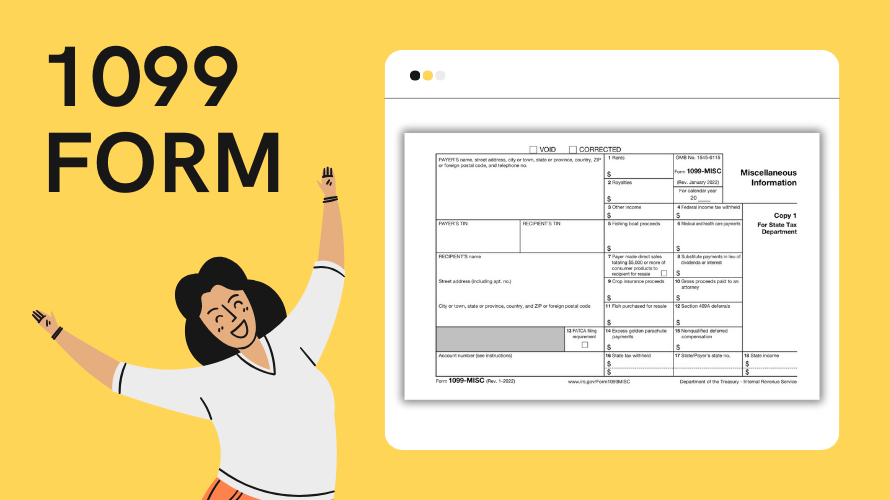

Filing taxes can be a bit overwhelming, but don't worry – we're here to help you understand the 1099 sample. Besides, using our website, you can obtain the 1099 tax form for free in PDF format. The 1099-MISC form is mainly used to report certain types of income other than wages, salaries, and tips. It includes several boxes, each serving a distinct purpose. Notable sections include:

- Recipient information

This part requires the name, address, and taxpayer identification number (TIN) of the person or entity who received the payment. - Payer information

Similar to the recipient part, this section includes the payer's name, address, and TIN. - Income boxes

These boxes should reflect the total amount paid in different categories, such as rents, royalties, and non-employee compensation.

Filling Out Your 1099-MISC Form Correctly

To ensure your 1099-MISC form is filled out accurately, follow these guidelines:

- Double-check the recipient's information to avoid any errors.

- Report each type of income in the corresponding box. For example, if you are reporting rent, it should go in Box 1.

- Include your taxpayer identification number, whether it's your Social Security Number or Employer Identification Number.

- If federal income tax was withheld, enter the total amount in the appropriate box.

- Make sure the figures you enter are exact and match your financial records.

Step-by-Step Guide to Filing Your Completed 1099-MISC Form

Once you've carefully filled out your free fillable 1099 form, follow these steps to file it:

- Confirm all information

Double-check for accuracy, ensuring all necessary details are complete. - Copy distribution

Keep a copy for yourself and provide copies to the IRS, the recipient, and the state tax department, if required. - Electronic filing

You can file 1099 online for free using the IRS FIRE system or other IRS-approved software programs. - Mail filing

If you prefer to mail your forms to the IRS, use the correct mailing address, which varies depending on your state. You can find this information on the IRS website.

Filing Deadline for the 1099-MISC Form

It's important not to miss the deadline for filing your 1099-MISC form. Generally, you must send the copy to the recipient by January 31st and file the form with the IRS by the same date if reporting non-employee compensation. For other types of payments, the deadline may differ, so it's crucial to check with the IRS for the exact dates pertaining to your situation.

Remember, you can print the 1099 form for free directly from our website. Having a free 1099 printable form at your fingertips can make your tax filing process much smoother. So, make sure to take advantage of the resources available to you and tackle your 1099-MISC with confidence!

Latest News

-

![1099 Tax Form Template]()

- 21 November, 2023

-

![1099-MISC Blank Form]()

- 20 November, 2023