1099 Tax Form Template

Taking a look back in time, the IRS Form 1099 has been a key document in the tax filing process for many years. This form was introduced to ensure that the Internal Revenue Service (IRS) could keep track of income generated from various sources other than a traditional salary. Over time, more versions of the form have been added to account for different types of non-employee income, such as rents, royalties, and even earnings from fishing boat proceeds!

IRS Tax Form 1099: Recent Changes

As the world of work and business has transformed, so has the 1099 form. Recognizing the shift towards a more digital and gig-based economy, the IRS periodically updates the form to reflect these changes. Recently, the reintroduction of Form 1099-NEC (Nonemployee Compensation) to report payments of $600 or more to freelance and independent contractors has been one of the most notable modifications. This change allows for clearer reporting of non-employee compensation, which was previously reported on Form 1099-MISC.

Who Needs the 1099-MISC Form?

Understanding who should use the IRS Form 1099 template is crucial.

- If you're a business owner or self-employed individual, you must issue one to every non-corporate service provider for whom you've paid $600 or more during the tax year. This is crucial for tracking payments that are not documented through traditional payroll systems.

- However, Form 1099 is not for everyone; if you’re an individual who earns a salary or wages, this form isn't for your use since your employer will report your earnings via a W-2 form.

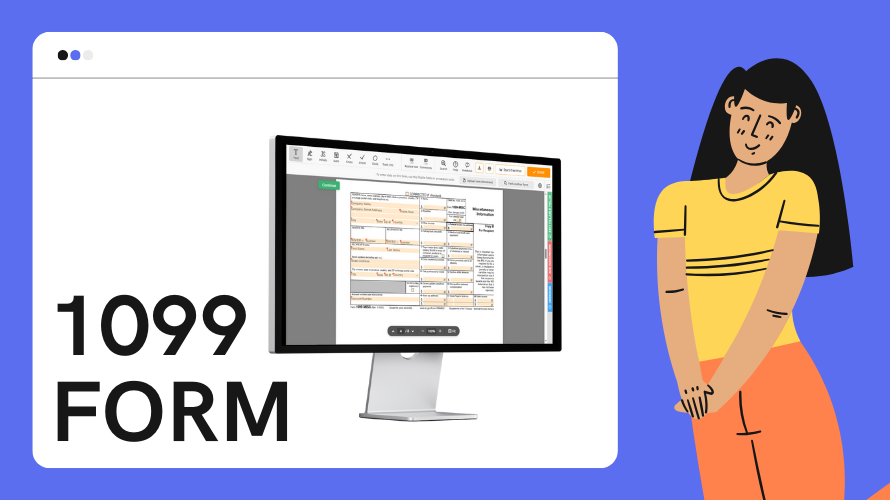

Accessing the 1099 Form Template Online

With tax season upon us, you might be looking for a free online 1099 form template to ease your workload. Fortunately, the IRS website offers free downloadable forms which you can use as templates. Plus, there are other online platforms and accounting software that offer the 1099 tax form template for free, which can save you time and ensure that you get the latest version of the form.

Printing Your 1099 Form

If you prefer to have a physical copy in hand, you can avail of the free printable 1099 template. These templates allow you to print out the forms and fill them in with the required information for each contractor or service provider you've compensated throughout the year. Remember, for official use, the IRS requires a specific red-ink version of the form, which is scannable. For record-keeping and informational purposes, a black-and-white version suffices.

Knowing how to use the 1099 forms properly can help you comply with tax laws and avoid penalties. Whether using a free online 1099 form template or a printable one, make sure you’re ready for tax season by being informed and prepared.

Latest News

-

![Free 1099 Printable Form]()

- 22 November, 2023

-

![1099-MISC Blank Form]()

- 20 November, 2023