IRS Form 1099: Printable & Fillable

New IRS 1099 Tax Form Instructions for 2023

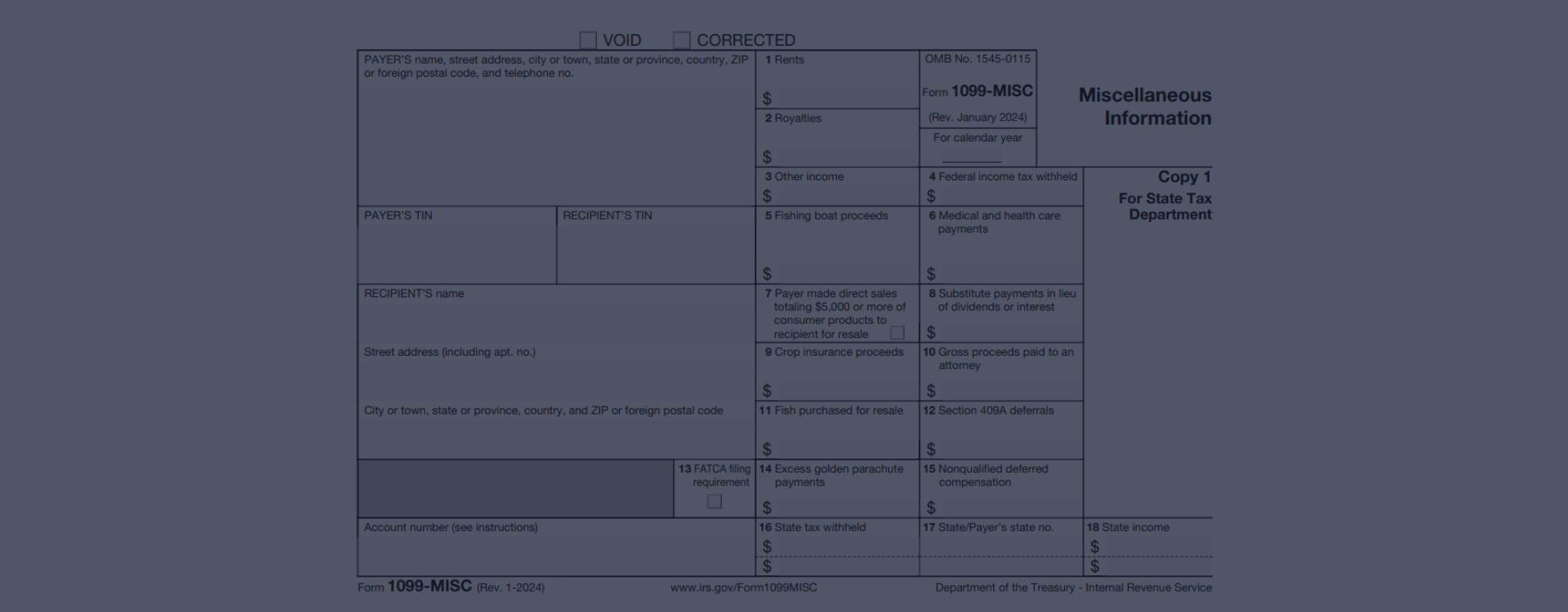

IRS Form 1099-MISC is a document you may need to fill out if you've paid someone for work but are not an employee. Generally speaking, IRS tax form 1099 for 2023 is for things like paying rent, prizes, or other income. It's a way to tell the Internal Revenue Service about money you've given to someone who isn't part of a regular job paycheck.

Now, let's talk about our website, 1099-irsform.com. It's a helpful place where you can find the IRS 1099-MISC form for download for the current tax year. With us, you can quickly get the form you need to report certain types of payments. Plus, we offer IRS Form 1099-MISC instructions that can guide you through each step of filling out the template correctly. We aim to make tax time less stressful. You'll also find examples that you can look at, which can be very useful to make sure you're doing everything right for 2023.

IRS Tax Form 1099-MISC & Reported Payments

If you've paid an independent contractor or any service provider more than $600 over the tax year, you'll need to fill out the 1099 IRS form for 2023 to comply with the law. This important document helps the IRS keep track of income that might not be reported otherwise, ensuring everyone pays their fair share of taxes.

Glossary

- Independent Contractor

- An independent contractor is a person or entity contracted to perform work for another entity as a non-employee. Independent contractors often have more control over their work, including how it's completed and what tools or methods are used, compared to employees. They are typically responsible for paying their taxes and benefits.

- Miscellaneous Income

- Miscellaneous income refers to money earned that does not fit neatly into standard income categories like wages or salaries. This can include earnings from freelance work, consulting, renting out property, receiving royalties, prizes, awards, or other varied sources. Miscellaneous income is often reported to the individual and the IRS on a Form 1099-MISC.

Example of the 1099-MISC Use

Let's imagine a person named Sarah. She owns a small graphic design business and hires Mark, a freelance web developer, to revamp her company's website. Mark is an independent contractor working on this single project for Sarah. Since she pays Mark $750 for his work, Sarah must complete the 1099 form to report the payment. By doing so, she provides the IRS with transaction details, and Mark can accurately report his income when he files his taxes. In this scenario, because Sarah's payment to Mark crosses the $600 threshold, she's responsible for providing Mark with the 1099 contractor form by the IRS deadline. This ensures that both Sarah and Mark stay compliant with tax laws, avoiding any potential penalties or misunderstandings with the IRS for 2023.

Tips to Fill Out the IRS 1099 Form Online

Filling out the 1099-MISC form is important for reporting certain types of income. By following these tax form 1099 instructions, you can complete your copy without mistakes. Remember to double-check all information before submission.

File Form 1099 to the IRS

If you need to file a 1099 form, it's important to mark your calendar for the due date. You'll want to submit the 2023 IRS 1099 form by January 31, 2024. Being on time is key to avoiding any trouble.

1099 Miscellaneous Form & Related Penalties

So, why is it so important to file on time and with the right details? If you miss the deadline, the IRS can charge you a penalty. It starts small but can get quite costly if you wait too long. And remember, honesty is the best policy. Providing false information on the IRS 1099 tax form printable can lead to even heavier fines or, in serious cases, legal trouble.

1099 Employee Form: Answering Your Questions

IRS 1099 Form: More Examples & Samples

Please Note

This website (1099-irsform.com) is an independent platform dedicated to providing information and resources specifically about the IRS 1099 form for 2023, and it is not associated with the official creators, developers, or representatives of the form or its related services.